Everyone understands their Uber rating score, and how that affects their likelihood of getting a driver. The higher the score, the better! Well, just like your Uber rating, your credit score determines your financial privileges too.

If you’re still scratching your head at this, let us break it down for you in the simplest terms possible.

What is Credit Score and how does it work?

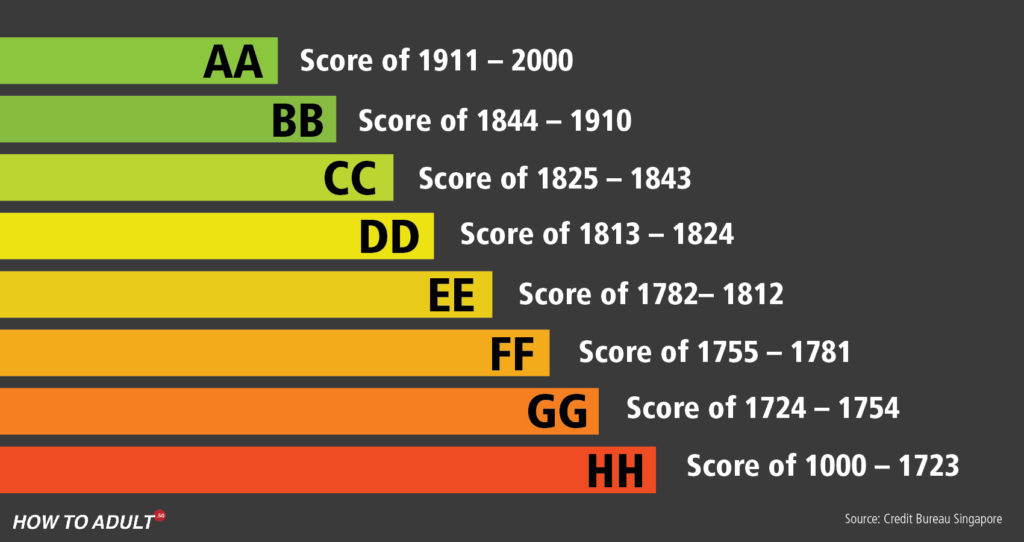

Credit Score Chart (Source: Credit Bureau Singapore)

Based on your loan repayment history and financial activities, your credit score is a four-digit number ranging from 1000 – 2000. The higher the number, the better your credit score.

Just like school, there are grades attached to this score. A score between 1911 – 2000 will earn you a Risk Grade AA, (AKA, the best score possible). The worst grades possible would be HH.

On the flip side – if you have no history of using loans or credit cards, you will have an ungraded score of Cx.

Your credit score is important as it informs the bank of your credit reputation, and whether you are a risky person to loan money to. It will determine if banks even loan you money to begin with, and the interest rates offered. Think about it this way, you wouldn’t lend someone your hard-earned money if the person has a history of not returning it, right?

And that, ladies and gentlemen, is why it is so important to maintain an excellent credit score! You’ll want to be able to qualify for the best and most attractive loan packages, especially when your adult responsibilities kick in. This includes getting a house, a car, or even when you want to start a business. A great credit score also increases your eligibility for credit card applications too.

Banks and Credit Bureaus

There are 2 credit bureaus in Singapore: Credit Bureau Singapore and DP Credit Bureau. They have developed credit scores that indicate the probability that a person will repay a loan.

The bureaus have data records of all your financial activity. Yes people – THEY KNOW EVERYTHING, which includes your personal data, loan repayment history, closed accounts, credit card balances and credit limits. Simply put, the data is crowdsourced from all the banks to be shared with each other and the credit bureau consolidates and manages all the data.

Think of the credit bureau as the cloud. Banks constantly ‘download’ and ‘upload’ your credit information. If a bank reports that you’ve made a late payment, your credit score may drop and you may pay higher interest rates.

You can purchase your credit report online via Credit Bureau Singapore and DP Credit Bureau. It should not cost you more than $6.

How to keep your credit score at the highest

1. First things first, sign up for a credit card once you start working

Applying for credit cards are a breeze once you’ve started working – it’s a gateway to your credit score. Your parents might have told you not to use a credit card because of all the horror stories of heavy debts and default payments. But come on, if you don’t have a credit card, how is the bank going to have your credit history?

- Use the credit card to pay monthly bills

Everything needs to be paid monthly, and on time. This includes your insurance premium, telephone bills, utility bills and many others. A way to fully utilise your credit card without spending on unnecessary items just to keep an active credit history, is to pay said bills.

- Treat the credit card like a debit card

The danger of the credit card is the delayed responsibility. You should never spend your ‘future money’ away. That’s always the first step to landing yourself in a bill you cannot afford to pay off. Instead, discipline yourself to keep a record of how much you’ve spent every time you swipe your credit card. You can set aside the amount in cash to ensure that you have sufficient money to pay the bills at the end of the month.

- 30% of credit limit is optimal

Financial advisers suggest that you should not utilise more than 30% of your credit limit because a high utilisation rate can lower your credit score.

2. Always repay loans and bills on time

This is a real no-brainer. There is just no fun in late payment for your credit cards. You will incur hefty interests and your credit score will take a plunge! Treat your credit card like a debit card, and that’ll hopefully save you the trouble.

For personal loans, you should inform your bank if you think you might miss the upcoming payment. Be proactive and arrange for alternative repayment methods by speaking with the bank. It will do less damage to your credit rating than defaulting the loan.

3. Having more credit facilities isn’t necessarily a good thing

As a general rule, avoid having more than four to five credit facilities (e.g. personal lines of credit, credit cards, personal loans, and so forth). It is inadvisable to hold six or seven credit cards or credit lines as you might get confused by the various billing cycles and miss payments.

Close off credit cards you no longer use, saving you from paying the annual fee. For personal lines of credit, there is little reason to have more than one. If you find a credit line with a lower interest rate, close your current credit line and switch to the cheaper alternative.

4. Avoid appearing ‘credit hungry’

You’re probably just excited to get things started, but remember that the number of loan applications are also monitored. Banks usually perceive multiple loan applications (i.e. 4 to 5) within a short period of time (i.e. one month), as someone being in financial difficulty.

This then leads to banks not trusting the individual.

Spread out your loan applications whenever possible, to avoid appearing ‘credit hungry’. Try using loan comparison sites such as gobear and SingSaver to compare the loans and credit cards as your first round of research. They are the Skyscanner of credit cards and loans. This should help you discern the better packages out there so you don’t have to send out multiple loan applications and enquiries at one go.

5. Life hack: Take up microloans to repair bad credit score

In the event of a bad credit grade, the easiest way to rectify the situation is to take up microloans. Borrow small sums (i.e. under $1,000) that you don’t actually need and repay it in full before the due date. This will eventually repair your damaged credit.

Start doing this for a year or two, before applying for major loans if your current credit grade falls anything below a BB. This could bring you to the coveted AA rating by the time you send in your application.