It’s payday! And we feel like a million dollars, even though it’s probably a pathetic fraction of that. Then, quicker than we’d expect, we’re feeling the pinch and praying for the next payday to come.

Good News: it’s possible to live comfortably AND save up your salary.

Bad News: It takes work, some financial planning and a bit of discipline.

Somewhat Good News: We’ve waded through a bunch of financial planning tactics, articles, and tools and condensed them into some really simple strategies that will help you (and us) save some of that sweet sweet salary.

At the end of the day, maximizing your salary is largely about how you can save more and spend less. We know it’s easier said than done, we will show you just some actionable ways to (i) Save more and (ii) Spend less.

How to save more

Method 1: Set Your Savings on Auto (recommended!)

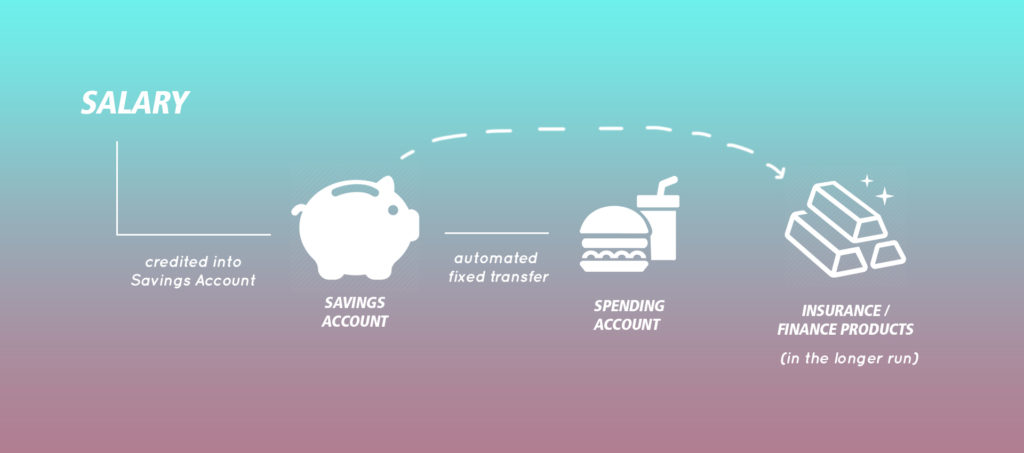

A simple yet effective way to save money is to use bank accounts to ‘force’ yourself to save. You will need at least 2 bank accounts to do this. One for salary crediting, the other purely for spending.

The bank account where your salary is credited to is your Savings Account. Don’t apply for an ATM card for that account, instead, set up an automated transfer to another account for spending in the coming month. You are allowed to spend every single cent in your Spending account (shiok!) because you have already set aside your savings!

Method 2: The Test-Water Method – Maximizing How Much You Save

Just as with cold water, the same can be applied with your savings. If you are not ready to dive right into forcing yourself to save, you can stick your toes into the water first, then when you’re comfortable, you’d lower more of yourself.

You can start by saving a rough gauge of 15-20% of your salary (dipping your toes in). If you are able to live rather comfortably, increase your savings percentage by 1-3% the next month (lowering more of yourself). Keep doing that until you’re living at a quality of life that’s unacceptable to you – like when you’ve substituted every meal with cup noodles. At that point, scale it back to your previous savings percentage and this is the maximum you can save from your salary each month. Of course, changes in salary and lifestyle affects how much you’d save, so remember to review it everytime you experience a major change.

How to spend less

Financial awareness might sound like a fluff-term insurance agents use but its basically an understanding of how we spend our money. As simple as it sounds, it can actually help to pinpoint potential spending pains and even make you spend less.

There is only one way to really do it – make a record each time you spend. Thankfully, there are finance tracker apps out there now to make the process less painful. However, if old school floats your boat, you can always do it with a notebook and an excel sheet too. Here’s how we’ve made the most out of my finance tracking attempts in 3 steps.

Step 1: Set your budget and priorities

Based on how much you want to save and your lifestyle choices, you should have a decent idea of your spending budget each month. You can then further break down your spending budget based on your priorities across different categories like health, household, transport, entertainment etc.

For example, if you’re a hardcore foodie, you might want to allocate 30% for food, and lower the percentage for transport and entertainment. And if you get tired every 50 steps and always wake up late, then you’d know you’ll need to channel more percentage into transport.

Of course, your priorities will change from time to time, so you’ll probably have to start with some rough guesses and then refine it each month.

Step 2: Track your spendings with a finance tracking app

Tracking your spending is pretty straightforward. Every time you spend money on something, record and detail what you spent based on categories. However, if you want to make full use of your finance tracking app you can also try these tricks:

- Trick 1: Record First, Spend Later

The natural steps are to spend first and then record later. But by recording the cost of your purchase before it happens, it gives you a moment to reconsider your decision and lowers the chance of an impulse buy. - Trick 2: Tagging Wants vs Needs

Finance tracking apps usually categorize your spending to various buckets like entertainment, transport, health, shopping etc. I find it helpful to also add Wants and Needs as additional tags. As with ‘Record First, Spend Later’, identifying between Wants and Needs really help to curb unnecessary spending. You’ll also get an overview of the percentage spent between Wants and Needs, giving you a fuller picture of your spending behaviour.

Step 3: Review your priorities and revise your spending habits

At the end of the month, check in to see if you stayed within your spendings budget. If you did, then you’re one step away from being less broke. However, it’d still be good to check if your spending matched your priorities.

If you exceeded your spending budget, this is where tracking really pays off. Now that you have an overview of your entire month’s spending, it’s easy to zoom in and identify which habit has unnecessarily burdened your budget. Maybe you’re taking the taxi too much and it broke your transport budget. Or perhaps your meals are getting too atas for your food budget.

Whatever it is, pinpoint one habit you could change immediately for the next month. It could be something as simple as cutting down on buying drinks and bringing a bottle with you. Targeting just one habit each month simplifies the process and makes it much more achievable.

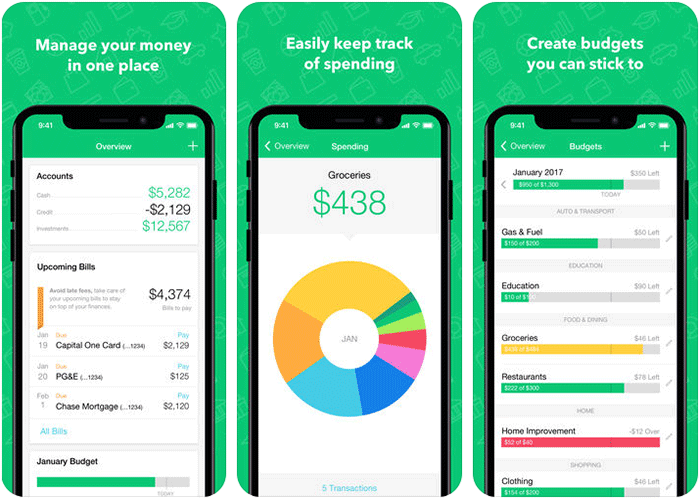

Tried & Tested: A few finance tracking apps we found helpful

Wally: For the I-just-want-it-to-be-simple

Wally has a clean and simple interface and works great as a fuss-free finance tracker. If you set your monthly spending goals, it even counts down how much you have left to spend to stay within your goals.

For people with the self-discipline to track their finances and know their spending goals, this app is perfect.

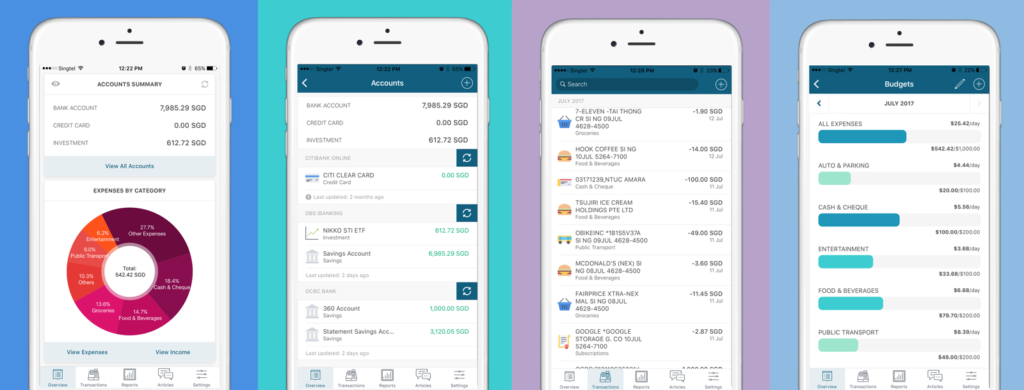

Seedly: For the Everything Also Paywave

Besides building a great community for financial advice, Seedly also has a finance tracker that works well for the tech-savvy. It allows you to sync multiple bank accounts and credit cards across different banks to give you an overview of your spendings.

The automated sync instantly categorizes your spendings saving you the time and effort of tagging each transaction. While most categories are rather accurate, some of the unidentified spendings will eventually fall into other expenses, so if you want a really clear overview, you’ll still have to edit it. Also, you won’t be able to keep track of your cash spendings, only a general sum for withdrawal, so you’ll have to input that manually go get a complete picture.

Still, if you are using your phone or cards for most of your transactions, Seedly can save you quite a bit of time.

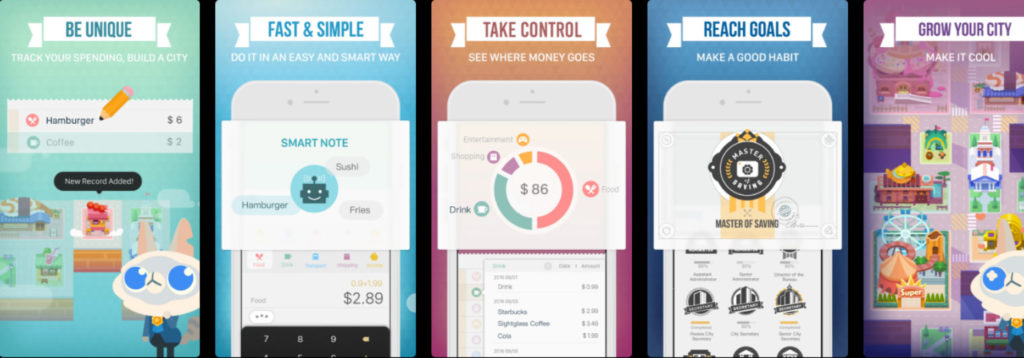

Fortune City: For the I-Forgot-To-Record-Again

Every transaction recorded in Fortune City becomes a building. Overtime as you track more and more of your expenses, you’ll get to combine buildings (to get fancier buildings), invite residents (or even kick them out if you don’t like their face) to build a bustling city. Beyond the fancy interface, it also has a smart recommendation system that suggests item descriptions based on your time and location (e.g. dinner because you’re in a restaurant at night or even milk tea because you’re standing in front of Koi).

All-in-all the gamification mechanics is a great way to make finance tracking a habit, especially for forgetful folks.

Do the Salary Salsa Now

Fact is, reading this doesn’t suddenly make you richer. It still takes a bit of initiative and discipline to actually get down to it. But if you’re willing to put in the work (at least some), automate your maximum savings, track your spendings and tweak your habits, you are well on our way to less-broke-ville.

If you have any adulting topics you’d like to find out more about, write in to us at hello@howtoadult.sg and let us do the homework for you.