CPF. You can already hear the collective groans of working adults across the country. Once you hit adulthood these three alphabets will find their way into every major milestone in your life from buying a house to paying medical bills all the way to retirement.

For something that will affect every Singaporean adult for the rest of our lives, our understanding of CPF seems limited to shoulder shrugs, “Give me back my salary!”, “BTO can use” and “what’s the age limit again?” But hopping on to the CPF site reveals 20 schemes and 28 calculators to help you use those schemes and we teared a little inside.

Nonetheless, we took the plunge and here’s an overview of what you need to know about CPF in simple English and more colours.

The idea of CPF: Your Default Piggy Bank

CPF might sound complex, but it really is just a legally enforced piggy bank. It’s the government forcing you to save so that you will have enough for retirement. Basically, the CPF money is invested by the government and you get a share of assured returns in your CPF accounts each year.

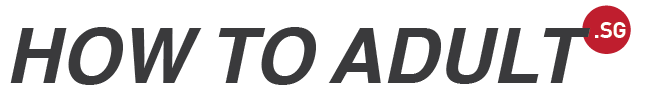

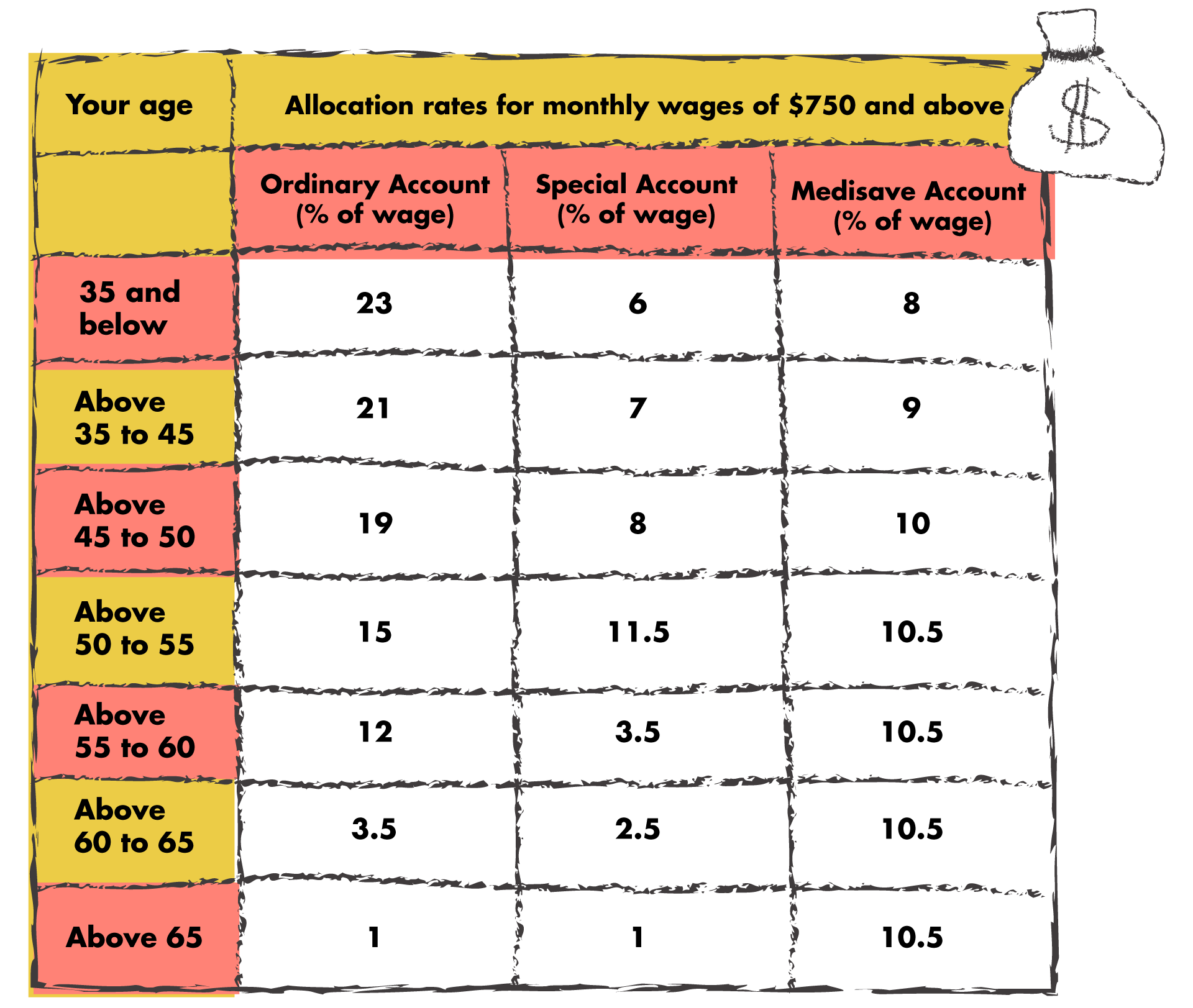

If you are employed, 20% of your paycheck goes into your CPF and your company tops up another 17%. If you are self-employed, CPF is voluntary except for Medisave. The percentage begins to drop past 55 years old as you won’t need to save as much anymore.

However, only the first $6,000 will be CPF-ed, meaning the maximum contribution that comes out of your salary is $1,200 no matter how high your salary goes. This is a total of $2,200 going into your CPF if you include your employer’s contribution.

However, only the first $6,000 will be CPF-ed, meaning the maximum contribution that comes out of your salary is $1,200 no matter how high your salary goes. This is a total of $2,200 going into your CPF if you include your employer’s contribution.

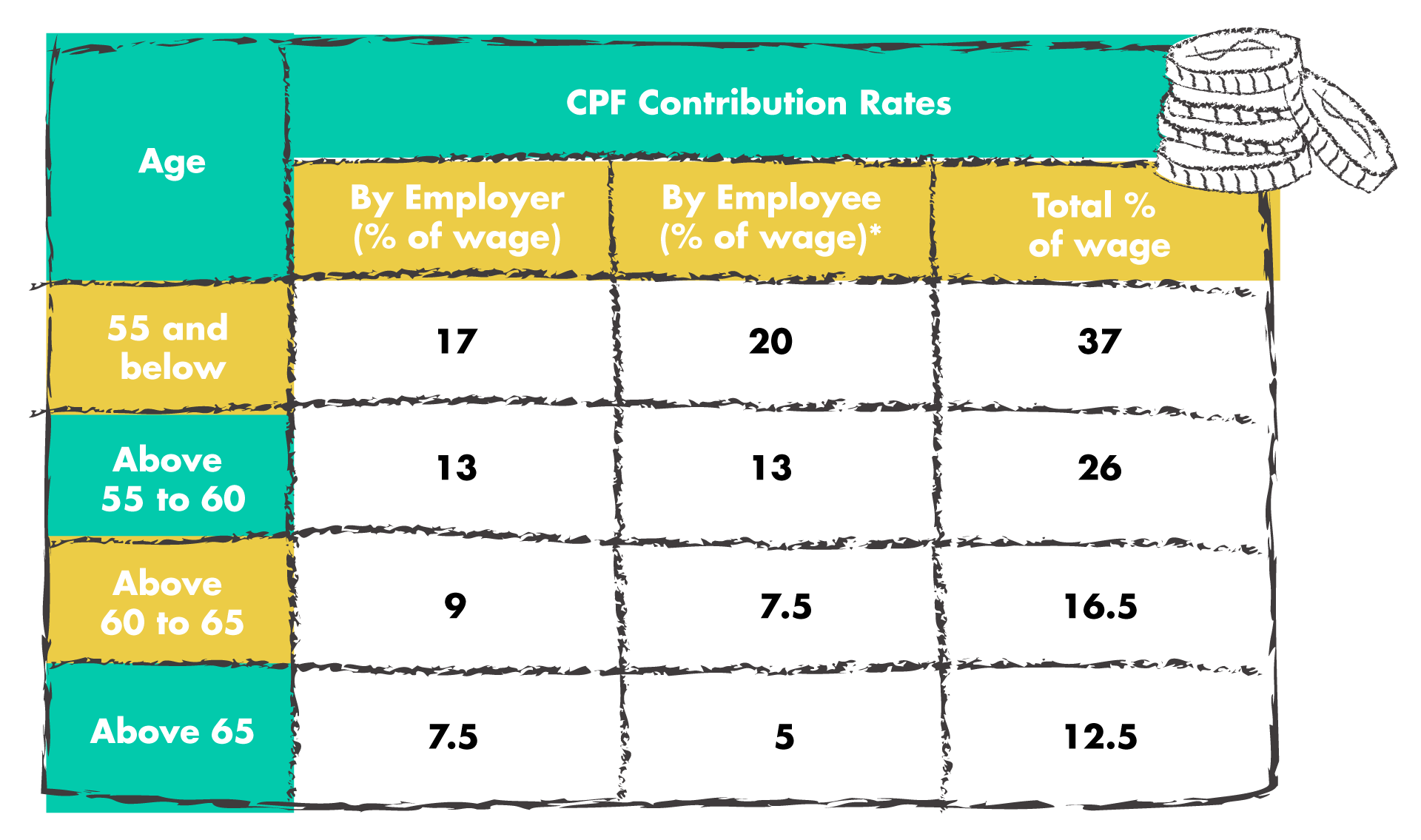

Your bonus will also be CPF-ed unless it hits a ceiling. Unlike the straightforward $6,000 for salary, your bonus ceiling is calculated based on $102,000 – Total Salary subjected to CPF for the Year.

So this is how it looks like if you are making $8,000 with 4 months bonus:

The CPF Threesome: Ordinary, Special, Medisave Accounts

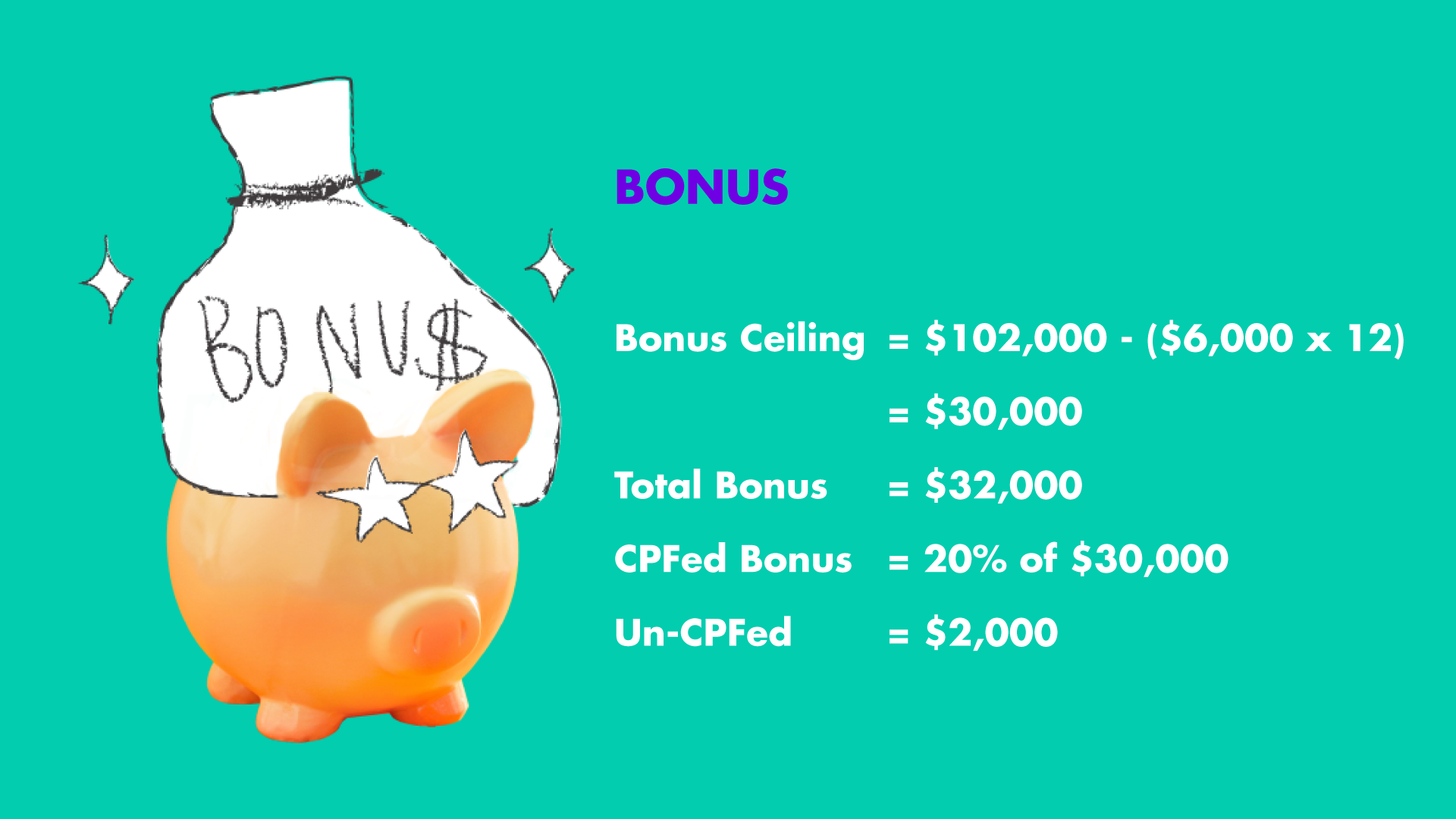

Remember when we told you your CPF was like a piggy bank? We lied. Your CPF actually looks more like three piggy banks.

Each one serves a different purpose and actually is allocated a different ratio of your CPF contributions. This allocation also changes with age as you’ll be more likely to need to pay for medical bills than to buy a house when you are in your 50s.

If you feel like you have more than enough in your Ordinary Account, you also have the option of transferring the amount in there to your Special Account for higher returns. However, once you make the transfer there is no going back, so think twice before you act!

As you hit 55, your Ordinary Account and your Special Account merge into one XL piggy bank, your Retirement Account.

- Retirement Account (RA) – Wondering why you don’t have one of these? That’s because you only get an RA when you turn 55. At that age, your OA and SA will merge to form your RA, which will contain your retirement savings.

Using your CPF Money

This is probably the part where you’d want to pay really close attention to. Other than yelling “CPF has my money locked down” here’s what you can also do with it.

Housing

One of the first time you’ll use your CPF money will probably be for buying a house. You can tap on your Ordinary Account to pay for:

- Housing loan taken for the home purchase

- Stamp duties, legal fees and other related costs

- Loan taken for the construction of your home or the purchase of vacant land, including the construction of a house (applicable for private properties only)

If you meet the qualifying criteria you can also apply for a CPF Housing Grant.

However, do note that when you sell your house, you’ll have to return the amount initially taken from your Ordinary Account along with interest. You can then use your Ordinary Account or Retirement Account to purchase your next property.

Education

A portion of your Ordinary Account can be used to pay for tuition fees for yourself or a family member. However, the amount taken out to pay for tuition has to be paid back into the account with interest after the course is over as well to ensure you are on track for retirement.

Investment

If you meet the minimum requirement here:

You are also eligible to tap on part of your Ordinary Account and Special Account for investments. The list of investment products are shortlisted by CPF and can be found here. Do note that any returns from the investments go back to your CPF accounts and that there are no guarantees that the investments will yield a higher return then CPF’s rates.

Medical

Your Medisave Account is exactly what it sounds like. It’s reserved to cushion your cost whenever a medical need arises. However, these have to be deemed ‘serious’ medical needs and cannot be used for ‘Don’t Feel Like Working’ MCs.

Beyond serious treatments, you can also tap on Medisave for preventative measures like to pay a portion for health insurance and also use it for check-ups and vaccinations. So do try to put it in good use even when you are young and healthy.

Here are some of the services covered:

- Hospital Stays ( More than 8 Hours)

- Psychiatric Hospital Stays

- Selected day hospitals or rehab centres

- Selected Outpatient Treatments

- Screening

- Vaccinations

- Childbirth

- Palliative Care

- Integrated Shield Plans

Retirement

Here’s the end game of CPF, your retirement. You’ll be able to start applying for payouts when you are at least 65 years old. There are three tiers of payout depending on how much you have left in your Retirement Account. The amount for each tier goes up every year with inflation, so when you are approaching middle age, you should keep an eye out on your CPF balance if you want a monthly payout.

As of 2018, if you have at least $60,000 in your Retirement Account, you are automatically in CPF LIFE where the payout continues for the rest of your life, no matter what how much balance you have left in your account. This is a relief if you have plans to become an immortal.

*

So as a quick recap, you should now know what the purpose of CPF is, how it’s structured and how you can use it. At the end of the day, CPF is still your money and it’s important to know where your money goes and how you can make it work for you.

If you have any questions about CPF or anything adulting, write in to hello@howtoadult.sg and let us do the homework for you. Follow us on Facebook and Instagram to take on adulthood one how-to at a time.